Alert:

A nationwide postal strike or lockout may occur as early as November 3, 2004. Dealer Members must take steps to ensure that document delivery requirements prescribed under CIRO Rules continue to be met.

Comments Due By: February 4, 2025

The Canadian Investment Regulatory Organization (CIRO) is publishing for comment Phase 4 of its Rule Consolidation Project rule proposals.1 The Rule Consolidation Project will bring together the two member regulation rule sets currently applicable to investment dealers2 and to mutual fund dealers3 into one set of member regulation rules applicable to both categories of CIRO Dealer Members.4

The objective of Phase 4 of the Rule Consolidation Project (Phase 4 Proposed DC Rules) is to adopt requirements that are mostly unique to the IDPC and MFD Rules and have been assessed as having differences deemed to be significant with potential material impacts on stakeholders.5

The Phase 4 Proposed DC Rules involves the adoption of rules relating to:

approval and proficiency for individuals,

managing significant areas of risk, and

business conduct and client accounts rules.

How to Submit Comments

Comments on the Phase 4 Proposed DC Rules should be in writing and delivered by February 4, 2025 (110 days from the publication date of this Bulletin) to:

Member Regulation Policy

Canadian Investment Regulatory Organization

Suite 2600

40 Temperance Street

Toronto, Ontario M5H 0B4

e-mail: [email protected]

A copy should also be delivered to the Canadian Securities Administrators (CSA):

Trading and Markets

Ontario Securities Commission

Suite 1903, Box 55

20 Queen Street West Toronto, Ontario M5H 3S8

e-mail: [email protected]

and

Capital Markets Regulation

B.C. Securities Commission

P.O. Box 10142, Pacific Centre

701 West Georgia Street, Vancouver, British Columbia, V7Y 1L2

e-mail: [email protected]

Commentators should be aware that a copy of their comment letter will be made publicly available on the CIRO website at www.ciro.ca

One of the initial CIRO priorities is to consolidate the IDPC Rules and MFD Rules into one set of rules, the CIRO Dealer and Consolidated (DC) Rules, applicable to both investment dealers and mutual fund dealers.

The primary objectives of this consolidation work are:

Taking these objectives into consideration, the following decisions have been made relating to the structure and content of the DC Rules:

| Matter | Decision |

|---|---|

| Rule organization structure and numbering approach | Use the IDPC Rule organization structure |

| Rule drafting convention | Standard rule with, where applicable, alternative compliance approaches to accommodate business model differences |

| Rule drafting style | Plain language |

| Rule development and implementation approach | The entire set of DC Rules will be implemented as a whole with an appropriate transition period. |

The fourth phase of the Rule Consolidation Project focuses on:

| Rule Series | Title and Description |

|---|---|

| 1000 | Interpretation and Principles Rules– provisions relating to:

|

| 2000 | Dealer Member Organization and Registration Rules – provisions relating to:

|

| 3000 | Business Conduct and Client Accounts Rules – provisions relating to:

|

| 4000 | Dealer Member Financial and Operational Rules – rules concerning Dealer Member financial and operational matters |

| 5000 | Dealer Member Margin Rules – Rules concerning margin requirements |

| 6000 | Reserved for future use |

| 7000 | Debt Markets and Inter-Dealer Bond Brokers Rules – Rules concerning debt market trading activities and inter-Dealer bond brokers |

| 8000 | Procedural Rules - Enforcement – rules concerning investigations, enforcement proceedings, disciplinary proceedings, hearing committees, and rules of practice and procedure |

| 9000 | Procedural Rules - Other – provisions relating to:

Procedures for Opportunities to be heard before Decisions on Approval and Regulatory Compliance Matters – DC Rule 9400 |

To provide details of the Phase 4 Proposed DC Rules, the following documents have been included as appendices to this Bulletin:

In the next sections of this Bulletin, we summarize the key elements of the Phase 4 Proposed DC Rules, which in most cases are the adoption of existing rule provisions from the IDPC Rules, the MFD Rules or both sets of existing rules. We also discuss how all proposed provisions differ from their corresponding IDPC Rule or MFD Rule provision in the Table of Concordance found in Appendix 3.

Taking into consideration stakeholder comments received regarding Phases 1-3, the following decisions have been made relating to the additional account types and services we will propose to allow mutual fund dealers to offer:

Whether to propose expansion of the account types that can be offered by mutual fund dealers: After discussing stakeholder comments with the Canadian Securities Administrators (CSA), it has been determined that CIRO will not proceed to propose to allow mutual fund dealers the ability to offer discretionary accounts, managed accounts or order execution only accounts as part of the Rule Consolidation Project. Any such proposals would be developed in consultation with the CSA as part of a separate policy project with a separate timeline.

To reflect this decision within the Phase 4 Proposed DC Rules, the application of the following requirements has been limited to investment dealers:

Other similar revisions will be proposed within the proposed Phase 5 amendments that relate to discretionary accounts, managed accounts and order execution only accounts.

Whether to propose expansion of the account services that can be offered by mutual fund dealers: After discussing stakeholder comments with the CSA, it has been decided that CIRO will proceed to propose to allow mutual fund dealers the ability to:

As such the following sections in the IDPC Rules, which already applied to the general term ‘Dealer Member’, have not been amended to reflect their applicability to Investment Dealer Members and/or Mutual Fund Dealer Members within the Phase 4 Proposed DC Rules:

Instead, substantive changes, including certain requirements that may only apply to a specific type of Dealer Member or activity, will be proposed in Phase 5. Similarly, substantive revisions to the Proposed DC Rules regarding the use of free credit cash balances will be detailed within the proposed Phase 5 amendments.

As is the case with all of the other Phase 4 Proposed DC Rules, these proposed expansions to the account services that can be offered by mutual fund dealers are subject to CSA review and approval. Further, should we receive a significant number of material comments on these proposed expansions that suggest that pursuing them will be highly controversial, we may decide to pursue them as separate proposals so as to not delay the completion of the Rule Consolidation Project.

In Phase 1, we adopted existing IDPC Rule section 1103 relating to delegation and asked stakeholders whether we should:

or

Most commenters believe that CIRO should generally permit delegation subject to specific prohibited exceptions itemized throughout the rules as they believe permitting delegation fosters flexibility and efficiency. Through our consultations, stakeholders further highlighted the need for clarity regarding the use of technology to manage regulatory processes.

In response to feedback received, we are proposing:

We believe these changes will support the increased demand for the use of regulatory technology, which will support the minimization of compliance risk, improve outcomes, and lower costs.

In Phase 1, we adopted the MFD Rule definition for “investment” as follows:

“Any asset, excluding cash, held or transacted in a client account by the Dealer Member.”

In Phase 4, we have decided to repeal and replace this “investment” definition with a new proposed definition for the term “investment product” as follows:

“ A product that:

We believe this proposed “Investment product” definition provides more clarity and flexibility as it:

Our intention with introducing this definition is to be able to clarify within our rules when a regulatory obligation relates to:

Within the remainder of the Phase 4 Proposed DC Rules, we have proposed using this new “investment product” defined term within the rule requirements relating to the following regulatory obligations

In this section of the Bulletin, we discuss the proposed requirements relating to:

Some of these requirements present a significant change to the MFD Rules with the intention to harmonize the standards for Approved Persons across Dealer Members with the existing requirements set out in the IDPC Rules. This harmonization ultimately ensures that investors across different types of Dealer Members will be serviced by professionals whose dispensing of investment advice, supervision, and senior oversight is regulated by the equivalent standards.

To avoid imposing unduly burdensome compliance requirements, where appropriate and pragmatic, the proposed Approved Person regime sets out an approach that has been tailored to mutual fund dealers. In this way, we seek to balance the objective of rule harmonization with the objective of rule scalability, the latter of which calls for rules that are proportionate to the different types and sizes of Dealer Members and their respective business models.

Our ultimate overarching view is that to best achieve harmonization under the Rule Consolidation Project, protect investor interests, and minimize industry confusion, the CIRO Approved Person regime (including the CIRO approval process, whereby an applicant must apply to CIRO and be reviewed and approved by CIRO in order to become an Approved Person) and the corresponding proficiency requirements, should apply to both investment dealers and mutual fund dealers.

However, at this time, we are proposing to extend the existing CIRO approval process to apply to the Approved Person categories of mutual fund dealers only where those categories are not subject to an underlying securities legislation registration requirement. Those mutual fund dealer Approved Person categories subject to an underlying securities legislation registration requirement will be automatically considered Approved Persons under the Phase 4 Proposed DC Rules, without being subject to the entire CIRO approval process. The rationale for this proposal is detailed in the below sections of this Bulletin.

Existing Approved Person regime

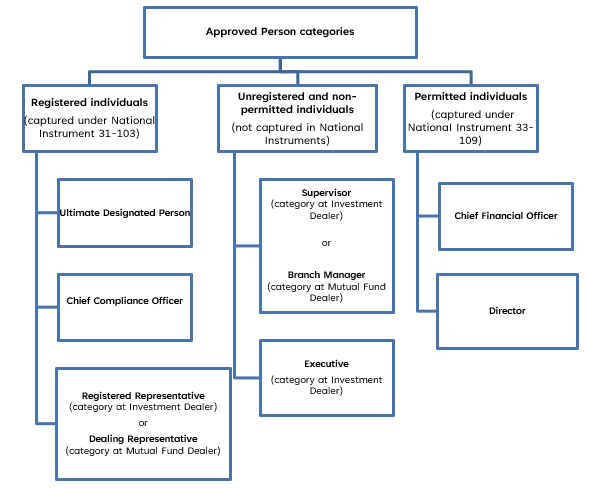

The following categories are included in the existing Approved Person regime under the IDPC Rules, MFD Rules and/or National Instrument 31-103 - Registration Requirements, Exemptions and Ongoing Registrant Obligations (National Instrument 31-103), and apply across both types of Dealer Members:

Proposed Approved Person regime for mutual fund dealers

For investment dealers, the CIRO approval process and the proficiency requirements for Approved Persons who also require securities registration are set out in the IDPC Rules. National Instrument 31-103 sets out the general requirement that individuals who conduct regulated activities be registered under securities legislation, but it is silent with respect to the proficiency requirements of these registered individuals where they are subject to the requirements of CIRO. This avoids having two separate regulations that cover the same regulatory ground.

In contrast, for Approved Persons of mutual fund dealers, the MFD Rules set out proficiency requirements for some categories of Approved Persons, while National Instrument 31-103 explicitly sets out the registration and proficiency requirements for registered individuals of mutual fund dealers who are also considered Approved Persons under the MFD Rules.

The Phase 4 Proposed DC Rules will replace these MFD Rule provisions and consequently CIRO’s Approved Person regime, including the CIRO approval process and proficiency requirements, will apply to all Dealer Members. However, based on the existing regulatory landscape and given the current drafting of National Instrument 31-103, the CSA proficiency requirements under National Instrument 31-103 would also continue to apply to registered individuals of mutual fund dealers. We recognize that industry and client confusion may result if the SRO review process and proficiency requirements for Approved Persons who are also registered individuals of mutual fund dealers are set out in two separate regulations across different regulators.

In contrast, under the existing regulatory regime, Approved Persons of a mutual fund dealer who are not subject to registration requirements under securities legislation are also not subject to a CIRO review at any point to be considered an Approved Person. Instead, the MFD Rules merely require that the mutual fund dealer ensure that said individual meets the requirements of that Approved Person category.

As such, under the Phase 4 Proposed DC Rules, we propose that any mutual fund dealer Approved Person category that is not subject to registration under securities legislation should be subject to the same CIRO approval process and proficiency requirements as their counterparts at investment dealers. Specifically, this will include the following categories of Approved Persons for mutual fund dealers:

To allow for these different approval requirements depending on the type of Dealer Member and Approved Person category, the Phase 4 Proposed DC Rules bifurcate the definition of “Approved Person” according to the type of Dealer Member. The definition that applies to investment dealers remains materially unchanged. However, the part of the definition that applies to mutual fund dealers must be read with the qualification set out in proposed DC Rule sub-clause 2551(1)(iii)(b), which states that the approval of a CCO, UDP, and Registered Representative will be automatic upon the individual’s registration. The effect of this drafting is that registered individuals of mutual fund dealers will be able to rely on the registration process under National Instrument 31-103 to be automatically considered an “Approved Person” under the Proposed DC Rules. (DC Rule subsection 1201(2) “Approved Person”)

Initial feedback is not uniform across the industry

Given that many different types of businesses, and individuals within those businesses, will be impacted by the harmonized Approved Person and proficiency regime, varied views on the best approach as to how to apply these requirements in the DC Rules are to be expected.

In Phase 1, we asked stakeholders to submit comments regarding the harmonization of the Approved Person regime. The feedback was varied and did not indicate that pervasive one approach would be preferred across the industry. In some instances, feedback was directly opposed to the feedback posed by other commenters. Some examples include:

We acknowledge that these proposed changes are likely to have a significant impact on mutual fund dealers. However, one of the primary objectives of the Rule Consolidation Project is to ensure that like activities of Dealers are regulated in a like manner. Standardizing the Approved Person regime and proficiency requirements will ensure that the clients of mutual fund dealers can be confident that their advisers, and the oversight of those advisers, are subject to the same standards as are afforded to clients of investment dealers. Each of these Approved Person categories are responsible in some way for regulated responsibilities. Allowing mutual fund dealers’ Approved Persons categories who are not subject to registration requirements under securities legislation to avoid any review process by a securities regulatory authority, while their investment dealer counterparts are subject to a CIRO approval process, results in too stark of a difference in the protections provided to their respective clients.

While this proposal presents significant changes to the approval and proficiency requirements for unregistered Approved Persons of mutual fund dealers, we have sought to avoid undue regulatory burden on mutual fund dealers by allowing Approved Persons that are registered individuals to continue to rely on that registration to meet the Approved Person requirements. Further, we intend to make these changes effective after a sufficiently long implementation period that allows impacted individuals adequate time to meet the proposed new, or materially changed, requirements.

Continuing education requirements under the proposed Approved Person regime

Note that under the IDPC Rules and MFD Rules, some of the Approved Person categories are subject to continuing education requirements. The continuing education requirements that apply to a given category of Approved Person are not harmonized across the IDPC Rules and MFD Rules.

CIRO is working on a separate project to review and update the continuing education requirements for the Approved Persons of both investment dealers and mutual fund dealers. That project falls outside of the scope of the Phase 4 Proposed DC Rules. Note that any changes to the continuing education requirements will be incorporated into the Rule Consolidation Project at a later stage.

This section pertains to Approved Person categories that are contemplated under both the IDPC Rules and MFD Rules, and that are also registered individuals under securities legislation (and whose proficiency and registration obligations are set out under National Instrument 31-103):

* Note: These roles are defined by these distinct categories under their respective Rulebooks. However, both roles are under the registration category of ‘dealing representative’ pursuant to securities legislation.

Approval process and proficiency requirements for Approved Persons who are subject to securities legislation registration requirements

At this time, we are not proposing to impose an additional CIRO approval process on mutual fund dealer Approved Persons subject to registration and proficiency requirements under National Instrument 31-103. Instead, where these individuals are registered in the equivalent individual registration category under National Instrument 31-103 (which includes the satisfaction of proficiency requirements listed therein), they will be automatically approved in the appropriate Approved Person category under the DC Rules.

For investment dealers, the existing CIRO approval and proficiency regime under the IDPC Rules, and the registration requirements under National Instrument 31-103, will continue to apply under the DC Rules.

Harmonizing the defined Approved Person category in DC Rules to align registered representatives and dealing representatives

Under both the IDPC and MFD Rules, Registered Representatives and Dealing Representatives (respectively) share substantively the same responsibilities and restrictions relating to their role as an Approved Person. This is by design: these roles are both fundamentally based on the registration category of dealing representative, as set out in National Instrument 31-103.

We propose using the same Approved Person category for this role across Dealer Members, specifically the title of a Registered Representative as defined in the DC Rules, to make it clear that these individuals fulfill the same general function across both types of Dealer Members.

The Supervisor and branch manager roles, as set out in the IDPC Rules and MFD Rules respectively, are highly similar with respect to their both general oversight function and specific responsibilities assigned.

The role of branch manager is unique to the MFD Rules, requires designation by the Dealer Member without being subject to CIRO review, and does not require registration under securities legislation.

The term Supervisor is unique to the IDPC Rules and does not require registration under securities legislation.

Both rulebooks refer to these roles as a specific Approved Person category. The key difference between the respective rulebooks is that a Supervisor is required to undergo review by CIRO to be considered an Approved Person. In contrast, a branch manager is only required to be designated by the sponsoring mutual fund dealer to be considered an Approved Person.

Harmonizing defined titles for Supervisors and branch managers

Given that the principles and core material responsibilities of a branch manager under the MFD Rules are already contemplated under the concept of Supervisor in the IDPC Rules, we propose to subsume the branch manager category of Approved Person under the existing IDPC definition of Supervisor. (DC Rule subsection 1201(2) “Supervisor”)

This retitling exercise does not necessarily result in material changes to the substantive responsibilities of branch managers of mutual fund dealers. The existing Supervisor requirements under the IDPC Rules are principles-based and can be broadly applied to encompass the existing responsibilities of branch managers under the MFD Rules, provided that the stated requirements for Supervisors are indeed met by the existing supervisory structure and responsibilities that a given mutual fund dealer has in place. For instance, the principles-based approach to supervision under the IDPC Rules does not rely on a physical branch or location to dispense a Supervisor’s responsibilities, but nor does it prohibit a location-based supervisory structure. As a result, if they so choose, mutual fund dealers may be able to apply their existing branch manager regime to comply with the requirements for Supervisors under the Proposed DC Rules, provided all requirements are met.

Lastly, the IDPC Rules contain a definition for the term “designated Supervisor,” which includes certain functions that are not relevant for mutual fund dealers. To harmonize the supervisory rules under the DC Rules and allow them to apply across Dealer Members, we propose to delete the term “designated Supervisor” and instead refer to Supervisors. Where specific proficiencies are required to supervise certain functions that only apply to investment dealers, those proficiencies are specified in the proficiency requirements. (DC Rule clauses 2602(3)(xviii)-(xxvii))

Harmonizing the Approved Person review process for Supervisors across Dealer Members

Mutual fund dealer Supervisors (currently defined as “Branch Managers” under the MFD Rules) are not registered under securities legislation. However, Supervisors carry significant oversight responsibility for functions that directly impact investors, given that they are responsible for oversight of registered individuals as well as providing oversight for client accounts.

To ensure investor protection and confidence with respect to these functions, we believe that CIRO must review applicants for Supervisors of mutual fund dealers in the same way that is currently required for their counterparts at investment dealers. This is necessary to ensure that CIRO has confirmed the adequate experience and aptitude of such an applicant prior to that individual being able to act in a Supervisor capacity and is aligned with the primary objective of ensuring that like Dealer Member activities are regulated in a like manner.

Maintaining proficiency requirements for Supervisors across Dealer Members

Given our proposal to harmonize the title and the CIRO Approved Person review process for Supervisors of investment dealers and mutual fund dealers, our ultimate goal is to harmonize proficiency requirements for these roles across Dealer Members.

However, there are significant differences between the existing proficiency requirements of an investment dealer’s Supervisor and a mutual fund dealer’s branch manager. As such, we propose to maintain the different existing proficiency standards in place for Supervisors across the different types of Dealer Members. An assessment of the appropriate proficiency for Supervisors, and whether that proficiency can be harmonized across Dealer Members, will be undertaken in a separate project.

The Approved Person category of “Executive” is set out within the IDPC Rules. The IDPC Rules not only define “Executive” as a type of Approved Person, but also require that:

However, this category does not require registration under securities legislation and is not explicitly contemplated as a type of Approved Person under the MFD Rules.

We propose to extend the category of Executive to apply to mutual fund dealers, for the reasons set out below. (DC Rule subsection 1201(2) “Executive”)

Clarifying amendments to the definition of Executive

We propose to streamline the definition of Executive by clarifying the types of individuals intended to be captured under this category of Approved Person.

The category of Executive is intended to capture individuals who are involved in a Dealer Member’s senior management that manage, and/or have authority over, areas of the Dealer Member’s business that involve, and/or have an impact on, regulatory requirements. The existing IDPC Rule drafting of the definition of Executive does not make this clear. Dealer Members have expressed confusion regarding whether every member of senior management listed in the existing definition needs to be approved as an Executive, even if they do not have responsibility as related to regulatory obligations. This is not the intended result of the Executive category.

Another concern with the existing definition of Executive is that it lists the positions of a Dealer Member’s Directors, and the Vice Chair and Chair of the board of directors. These individuals are already captured under the Approved Person category of Director and should not be captured as Executives unless they also meet the criteria as described in the proposed definition.

See section 2.3.5 of this Bulletin for a summary of the proposed changes related to these roles under the requirements for Director.

Managing significant areas of risk

Rule 1500 of the IDPC Rules sets out that investment dealers are required to assign Executives to manage significant areas of risk within the firm. We believe that these requirements are also appropriate for mutual fund dealers, as they ensure that all significant areas of risk are managed by an individual whose proficiency and experience has been approved by CIRO. (DC Rule 1500)

However, we acknowledge that there may be less complexity in the corporate structure of smaller mutual fund dealers, and that they may not have internal structure that is complex or layered enough to require that additional Executives be assigned to manage risks beyond the purview of existing mandatory Approved Persons (namely, as the UDP and CCO).

Our proposed drafting accommodates these different business structures without imposing unnecessary regulatory burden. The proposed amendments to definitions of Approved Person and Executive must be read with DC Rule sections 2505 - 2507 and the requirements set out in DC Rule 1500. These provisions confirm that the UDP, CCO and CFO must be Executives. Notably, there is no requirement in Rule 1500 that a Dealer Member must appoint Executives beyond the UDP, CCO, and CFO. Therefore, mutual fund dealers who opt to rely on existing Executive roles (namely, the UDP and CCO), with the proposed required addition of the CFO role, to fulfill Rule 1500 will be able to do so assuming that their oversight structure is sufficient for its business and meets all requirements under the DC Rules.

This result provides flexibility in that mutual fund dealers who wish to designate additional Executives to manage significant areas of risk may do so, without creating a requirement that all mutual fund dealers designate Executives beyond the UDP, CCO and CFO to meet their obligations under proposed DC Rule 1500.

Harmonize proficiency requirements for Executives across Dealer Members

Given our proposal to apply the Approved Person category of Executive to Mutual Fund Dealer Members, we likewise propose applying the same corresponding proficiency requirements to Executives generally across Dealer Members. (DC Rule clauses 2602(3)(xxviii) and 2602(3)(xxxvi))

However, we have proposed that the proficiency requirements for Executives should not apply to the categories of UDP and CCO for a mutual fund dealer at this time. Consistent with the rationale set out in section 2.3.2 of this Bulletin, we propose that the UDP and CCO, who are required under the IDPC Rules to be designated and approved as Executives, will automatically be approved as an Executive upon their securities registration with the applicable securities regulatory authorities. (DC Rule clauses 2602(3)(xxxvi), and 2602(3)(xxxix), and 2602(3)(xl))

Directors are permitted individuals under National Instrument 33-109 Registration Information (National Instrument 33-109) and are a type of Approved Person under both the IDPC and MFD Rules.

However, several differences apply between the IDPC Rules and MFD Rules regarding directors as Approved Persons. While the IDPC Rules set out proficiency requirements for Directors, the MFD Rules and the National Instrument 33-109 do not. Under the IDPC Rules, Directors are also subject to CIRO’s approval process to be considered an Approved Person, whereas directors under the MFD Rules are not.

Harmonizing the definition of Director across Dealer Members

Given that directors were already identified as a type of Approved Person under the MFD Rules, there is no reason not to apply Directors as a category of Approved Person under the DC Consolidated Rules. As such, we propose harmonizing the term ‘Director’ as defined under the IDPC Rules to apply across Dealer Members. No material changes need to be made to the definition of Director to effect this change. (DC Rule subsection 1201(2) “Director”)

Harmonizing the Approved Person regime and proficiency requirements for Directors across Dealer Members

We propose to impose the same Approved Person regime, including the proficiency requirements set out in the IDPC Rules, for all Directors under the Phase 4 Proposed DC Rules. (DC Rule clauses 2602(3)(xxix) and 2602(3)(xxxvii))

Amendments to the general requirements for Directors

The existing general requirements for Directors set out under IDPC Rule subsections 2502(2) and 2502(3) are not clear and conflate, in some respects, the requirements of Directors with the requirements of Executives set out in IDPC Rule section 2503. As such, we propose to adopt a modified version of the IDPC Rule provisions relating to the general requirements for Directors. (DC Rule section 2502)

In our view, CIRO should not mandate that at least 40% of a Dealer Member’s board of directors be actively engaged in the Dealer Member’s, or a regulated affiliate’s, business. This requirement is not aligned with the role of directors under corporate law. Instead, the language “actively engaged” better describes the responsibilities of Executives, and as such has been included as a general requirement for Executives. (DC Rule section 2503)

The IDPC Rules define the term Chief Financial Officer (CFO) and state that an investment dealer must designate a CFO. The IDPC Rules assign key responsibilities to the CFO, specifically requirements that require financial subject matter expertise to them. The IDPC Rules further state that a CFO must also be an Executive and set out specific Proficiency requirements for them.

In contrast, mutual fund dealers are not required to designate a CFO as an Approved person under the MFD Rules, nor are CFOs required to be registered pursuant to securities legislation. CFOs are captured under the description of permitted individuals under National Instrument 33-109, but the term in not defined in the MFD Rules and no specific proficiency requirements are imposed upon the CFO role under either the MFD Rules nor National Instrument 33-109.

Furthermore, while requirements that relate to financial obligations are assigned to the CFO under the IDPC Rules, those obligations are either assigned to the mutual fund dealer itself or its UDP under the MFD Rules.

CIRO’s understanding of current industry practice for mutual fund dealers is that to fulfill requirements that require financial expertise, many mutual fund dealers typically outsource these requirements to a third-party, such as an auditing firm or utilizing a CFO who performs similar duties for multiple related entities in a large organization. Note, however, that even in these scenarios, under the MFD Rules and National Instrument 31-103 the UDP cannot outsource the ultimate responsibility for the mutual fund dealer to meet its financial obligations.

Applying the CFO requirement across Dealer Members

We propose to adopt the IDPC Rule provisions relating to the general requirements for CFOs across Dealer Members for the following reasons:

We have included a question in section 5 of this Bulletin asking for your views on how the CFO requirement could be scaled to better reflect the typical business structure of mutual fund dealers.

Harmonize the Approved Person regime and proficiency requirements for CFOs across Dealer Members

Under the IDPC Rules, CFOs are subject to the Approved Person regime. We propose to impose the same requirements to CFOs across both types of Dealer Members under the Phase 4 Proposed DC Rules, including the corresponding proficiency requirements.7

IDPC Rule 2800 sets out the obligations of investment dealers when using the National Registration Database (NRD). The changes proposed and discussed in the above sections do not require, at this point in time, amendments to the drafting of Rule 2800. To facilitate the use of NRD, we propose that Rule 2800 apply to all Dealer Members, including mutual fund dealers.

In this section of the Bulletin, we discuss the proposed amendments to rule requirements relating to:

that may represent a significant format or substantive change to current requirements set out in either the IDPC Rules or the MFD Rules. In general, except where noted, the DC Rules represent existing expectations about conflict-of-interest management obligations that are articulated in various sections of the current rules and guidance, and therefore do not impose material new obligations on investment dealers or mutual fund dealers.

We propose to adopt the IDPC Rule provision that requires that an investment dealer have policies and procedures that specifically address material conflict of interest situations. (DC Rule section 3109)

The MFD Rules do not have an equivalent specific provision that requires a mutual fund dealer to have such policies and procedures but rather have a general requirement to establish and maintain policies and procedures.

We propose to adopt the IDPC Rule provision that restricts both investment dealer employees and Approved Persons from engaging in any personal financial dealings with clients. The provisions in the equivalent MFD Rules apply only to mutual fund dealer Approved Persons, and do not extend to employees.

It is critical to the integrity of the investment industry to minimize and manage all reasonably foreseeable potential sources of conflicts of interest, which would include conflicts of interest involving employees of Dealer Members. As such, we believe it is appropriate to adopt the IDPC Rule prohibition on engaging in personal financial dealings with clients and apply it to both employees and Approved Persons of all CIRO Dealer Members. (DC Rule subsection 3110(1))

Both the IDPC Rules and the MFD Rules prohibit Approved Persons8 from accepting any consideration from any person other than the Dealer Member for activities conducted on behalf of a client. The IDPC Rules, however, provide exceptions to this rule where such consideration is non-monetary, of a minimal value and infrequent, such that a reasonable person would not question whether it created a conflict of interest or otherwise improperly influenced the Dealer Member or its employees, or where compensation relates to an approved outside activity.

We believe these are reasonable exceptions, consistent with those articulated in MFD Rules guidance dealing with personal financial dealings.9 We therefore propose to adopt these exceptions. (DC Rule clause 3110(2)(i))

The IDPC Rules specify that entering into a settlement agreement and/or paying for client account losses out of personal funds without the Dealer Member’s prior written consent are both prohibited personal financial dealings. Although the MFD Rules do not address these activities, MFD guidance dealing with personal financial dealings specifies that no Approved Person may enter into any settlement agreement with a client without prior written consent of the member. We believe the IDPC Rule restrictions are reasonable and propose to adopt this provision. (DC Rule clause 3110(2)(ii))

Both the IDPC Rules and MFD Rules prohibit Approved Persons10 from borrowing from a client, except where the client is a Related Person pursuant to the Income Tax Act (Canada) and where the Approved Person has obtained written approval of their sponsoring Dealer Member. The IDPC Rules, however, specify that written approval of the member is required only where the Approved Person is an Associate Portfolio Manager, Portfolio Manager, Investment Representative or Registered Representative. We propose to adopt the additional IDPC Rule provision, which targets the most salient conflict, involving client facing Approved Persons.

We also propose to adopt the IDPC Rule exception that permits borrowing from clients that are financial institutions whose business includes lending money to the public and the borrowing is in the normal course of the institution’s business. This activity does not present a conflict and extending the exception to mutual fund dealers allows these Dealer Members’ employees and Approved Persons to undertake normal course banking activity. (DC Rule clause 3110(2)(iii))

Both the IDPC Rules and the MFD Rules prohibit Approved Persons11 from lending to a client except where the client is a Related Person pursuant to the Income Tax Act (Canada) and where the Approved Person has obtained written approval of the Dealer Member. The IDPC Rules, however, specify that written approval of the member is required only where the Approved Person is an Associate Portfolio Manager, Portfolio Manager, Investment Representative or Registered Representative. We propose to adopt the additional IDPC Rule provision, which targets the most salient conflict, involving client facing Approved Persons. (DC Rule clause 3110(2)(iv))

Both the IDPC Rules and MFD Rules prohibit Approved Persons12 from acting as a power of attorney, trustee, executor or otherwise having full or partial control of the affairs of a client. The MFD Rules, however also prohibit Approved Persons from accepting these positions. Under the IDPC Rules, although the source of the conflict arises upon the acceptance of the position, it is not a violation of the rules until the event triggering the Approved Person’s responsibilities occurs (e.g. the death or disability of the client). In order to mitigate the issues and complications that arise when the arrangement is required to be unwound at the time it takes effect, we propose to adopt the requirement in the MFD Rules that prohibit accepting such positions.

As with the other personal financial dealings, there are exceptions where the client is a Related Person pursuant to the Income Tax Act (Canada) and where the Approved Person has obtained written approval of the Dealer Member. The IDPC Rules, however, only require written approval of the member where the Approved Person is an Associate Portfolio Manager, Portfolio Manager, Investment Representative or Registered Representative. We propose to adopt the IDPC Rule provision in the DC Rules, as it addresses the most salient conflict, where client facing registrants are involved. (DC Rule clause 3110(2)(v))

We propose to add a new restriction to prohibit Approved Persons and employees from accepting beneficiary status or bequests from a client’s estate except where the client is an immediate family member, and in the case of Associate Portfolio Managers, Portfolio Managers, Investment Representatives and Registered Representatives, the proposed status or bequest is disclosed to and approved in writing by the Dealer Member. We propose to define “immediate family” as parents, grandparents, mother-in-law or father-in-law, spouse or domestic partner, brother or sister, brother-in-law or sister-in-law, son-in law or daughter-in-law, children, grandchildren, cousin, aunt or uncle, or niece or nephew, and any other person who resides in the same household as the Approved Person or employee and the Approved Person or employee financially supports, directly or indirectly, to a material extent. The term includes step and adoptive relationships. We are using the term ‘immediate family” rather than “Related Person” in this provision to ensure the exemption is appropriately targeted to the specific familial relationships that are commonplace in estate related circumstances, and generally do not give rise to conflict-of-interest concerns. (DC Rule clause 3110(2)(vi))

We propose to adopt a modified version of the MFD Rule provisions relating to referral arrangements. The IDPC Rules do not have similar specific provisions, which are contained in sections 13.7 through 13.10 of National Instrument 31-103. Given the frequent use of these provisions by all Dealer Members, we believe they should be included in the DC Rules. (DC Rule section 3114)

In this section of the Bulletin, we discuss the proposed amendments to requirements relating to:

that may represent a significant format or substantive change to either the IDPC Rules or the MFD Rules. In general, except where noted, the DC Rules represent existing expectations about know-your-client obligations that are articulated in various sections of the current rules and guidance, and therefore do not impose material new obligations on investment dealers or mutual fund dealers.

We propose to adopt the IDPC Rule provisions, which are less prescriptive than their MFD Rules equivalent13 and require Dealer Members to take reasonable steps to collect sufficient know-your-client information regard the client’s (1) personal circumstances, (2) financial circumstances, (3) investment needs and objectives, (4) investment knowledge, (5) risk profile and (6) investment time horizon. The specific documentation that would support complying with this obligation will be contained within guidance, which will allow Dealer Members to tailor their information gathering to their respective business. (DC Rule section 3202)

We also propose to specify that the requirement to establish whether the client is an insider of a reporting issuer is imposed only on investment dealers, as such obligations are not required of mutual fund dealers.14 (DC Rule section 3202)

We propose to adopt the IDPC approach to disclosure which requires that in the case of a trust, the names and addresses of all trustees and known beneficiaries and settlors of the trust be disclosed. This is a more stringent standard than the MFD approach for trusts, which only requires disclosure of those with control over the affairs of the partnership or trust.15

We also propose to adopt the IDPC Rule provision that requires that the names of all directors of a corporation be disclosed within 30 days of opening the account. There is no similar disclosure requirement in the MFD Rules. (DC Rule sections 3203 and 3204)

We propose not to adopt MFD Rule 2.2.4(e), that requires that a mutual fund dealer must annually request that each client notify them if there has been any material change in client information previously provided. We believe that this requirement is unduly burdensome, and that it is preferable to adopt the requirements in IDPC Rule subsections 3209(3) and 3209(4) which are consistent with equivalent provisions in National Instrument 31-103 requiring that Dealer Members:

To fully harmonize with the equivalent requirements in National Instrument 31-103, we also propose to adopt MFD Rule 2.2.4(f)(i), for mutual fund dealers only. This provision requires a mutual fund dealer to review the client’s information within 12 months when transacting in securities it is permitted to transact in because it is registered as an exempt market dealer. (DC Rule section 3209)

We propose to adopt the IDPC provisions that specifically set out the elements that must be included in a Dealer Members’ policies and procedures in respect of account opening. These provisions are generally consistent with those contained in various MFD Rules and guidance,16 which are not consolidated in one provision, but dispersed throughout the MFD Rules. Grouping related regulatory requirements together promotes regulatory certainty. (DC Rule section 3213)

We also propose to adopt a modified version of the IDPC Rule provision that limits the activity in an account to liquidating trades, paying out funds or delivering out investment product positions to the client if the Supervisor does not approve a new account after the initial trade. The corresponding MFD Rule provision17 restricts the activities to liquidating trades. (DC Rule section 3214)

We propose to adopt the MFD Rule provision for mutual fund dealers only, that permits a mutual fund dealer to use a copy of a client’s current account information where they are transacting in securities that require registration under securities legislation as an exempt market dealer, if the account was approved in the past 12 months. (DC Rule section 3215)

We propose to adopt the IDPC Rule provisions relating to relationship disclosure. The IDPC Rule provisions are more comprehensive than what is contained in the MFD Rules but consistent with MFD Rules guidance dealing with relationship disclosure.18 (DC Rule section 3216)

We propose to adopt a modified version of the IDPC Rule provisions relating to the acceptance of specific account types that can be offered by investment dealers, namely derivatives accounts, discretionary accounts, and managed accounts. These changes are meant to clarify the current IDPC Rule drafting, and we expect that they will not impose an additional burden on investment dealers. (DC Rule sections 3251, 3273, 3277)

The derivatives disclosure statement required to be provided by an investment dealer to clients with derivatives accounts under DC Rule section 3251 is included in Appendix 5.

In this section of the Bulletin we discuss the proposed amendments to requirements relating to know-your-product and product due diligence.

As discussed in section 2.2.2, we have proposed adding a definition of “investment product” in section 1201. This definition provides more clarity in respect to which products, when offered, are subject to the core regulatory obligations that Dealer Members and their Approved Persons owed to their clients. In describing these obligations, the IDPC Rules relating to product due diligence and know-your-product refer to “securities or derivatives” while the equivalent MFD Rules refer to “investments”, which is broader in scope than the definition of “securities or derivatives”.

Proposed DC Rule sections 3301 (Product due diligence) and 3302 (Know-your-product) specify that these obligations apply to “investment products” to capture other products that a Dealer Member may offer to clients alongside of securities or derivatives. (DC Rule sections 3301 and 3302)

In this section of the Bulletin, we discuss the proposed amendments to requirements relating to:

that may represent a significant format or substantive change to either the IDPC Rules or the MFD Rules. In general, except where specifically noted, the proposed DC Rules represent existing expectations about suitability that are articulated in the current rules and guidance, and therefore do not impose material new obligations on investment dealers or mutual fund dealers.

As mentioned in section 2.2.2, we propose to use the term “investment products” to identify the products held by the client that are subject to the suitability determination obligation.

In Phase 1, we asked stakeholders whether Dealer Members should have the options of:

Most commenters believe Dealer Members should have the option to categorize clients as “institutional” or “retail,” as this choice enables flexibility.

In response to feedback received, we are proposing to retain the IDPC Rule suitability determination provisions that distinguish between retail and institutional clients. The MFD Rules did not make such distinctions, as the client base was all deemed to be retail.

We propose to retain the IDPC Rule provision which requires that a Dealer Member must determine whether it is suitable for a retail client to continue having an account with the Dealer Member. This determination is a key element of ongoing suitability responsibilities.

We also propose to include the IDPC Rule provision which requires that the scope of products, services and account relationships to which the retail client has access to within the account, are suitable for the retail client.

In addition, we propose to adopt the approach in the IDPC Rules, which requires Dealer Members to respond to specific events or changes in the client’s account within a “reasonable time”. This differs from the MFD Rule19 approach which, in particular, specifies that suitability assessments must take place within defined periods where there is a transfer of assets into an account at the mutual fund dealer,20 where the client account is re-assigned to the Registered Representative from another registrant at the mutual fund dealer,21 or when the mutual fund dealer or Registered Representative becomes aware of a material change in the client’s KYC information.22 We believe the IDPC approach provides more flexibility without impairing investor protection. (DC Rule section 3402)

We propose to adopt a modified version of the MFD Rule provision23 which specifies that if, after performing a suitability determination, a Dealer Member has determined that an action taken for a client does not meet the suitability determination requirements, the Dealer Member must advise the client, make recommendations to address any inconsistencies, and maintain evidence of such recommendations. This provision addresses situations where the unsuitable investment may have not arisen from the action of the Dealer Member or Approved Person, such as the transfer-in of investment products. We expect that this represents existing practice and will not impose an additional burden on investment dealers. (DC Rule subsection 3402(5))

We propose to adopt a modified version of the MFD Rule provisions24 requiring Dealer Members to have policies and procedures: (1) to assess the appropriateness of leverage strategies, (2) that set out the process for approval for such strategies, and (3) set out related documentation requirements.

This requirement will ensure Dealer Members are mindful of and have procedures to manage the risks inherent in retail clients using borrowed funds to invest. Note that the IDPC Rule Guidance on Borrowing for Investment Purposes25 will be retained and may be supplemented by the more detailed provisions in the MFD Rules. (DC Rule subsections 3402(6) and 3402(7))

The majority of the provisions in DC Rule 3500 are not applicable to mutual fund dealers, as they deal with matters related to investment banking and distributions. Other provisions related to fees in this Rule that may also apply to mutual fund dealers, are consistent with the requirements in MFD Rules, and National Instrument 81-105 Mutual Fund Sales Practices.

In this section of the Bulletin we discuss the proposed amendments to the requirements relating to advertisements, sales communications and client communications that may represent a significant format or substantive change to either the IDPC Rules or the MFD Rules.

We propose to adopt the approach of review and approval of advertisements, sales communications and client communications taken in the IDPC Rules. Whereas the MFD Rules require that all such communications be “first approved by a partner, director, officer, compliance officer or branch manager”, the IDPC Rules mandate such pre-approval by a Supervisor only for specific types of communication,26 and that the balance be “reviewed in a manner appropriate to the type of material”. We believe this risk-based approach is appropriate and has not resulted in inappropriate publication of material.

We also propose to adopt the MFD Rule provision27 which prohibits communication that uses “an image such as a photograph, sketch, logo or graph which conveys a misleading impression.” This specific prohibition is not currently contained in the IDPC Rules, and we believe it provides additional clarity.

We propose not to include the section in the MFD Rules28 that prohibits client communications that are “inconsistent or confusing with any information provided by the Member or Approved Person in any notice, statement, confirmation, report, disclosure or other information either required or permitted to be given to the client by a Member or Approved Person under the Rules or Forms.” We believe this provision is subjective in respect of what might be considered inconsistent and confusing to a client, and is not necessary as misleading information is prohibited under other sections of this Rule.29

We propose to adopt the IDPC Rule that requires that a Dealer Member retain copies of all advertisements, sales literature and correspondence and all records of supervision for the applicable retention periods. While the MFD Rule relating to books and records30 indicates that records which document correspondence with clients must be retained, the IDPC provision is more specific and captures all relevant documents.

We also propose not to include the provision in the MFD Rules31 mandating specific disclosure and Member approval for any reference to rates of return for account reports other than in the investment performance reports. We believe this requirement may lead to confusion, and is not necessary, as misleading information is prohibited under other sections of this Rule.32 (DC Rule section 3602)

In this section of the Bulletin we discuss the proposed amendments to requirements relating to:

that may represent a significant format or substantive change to either the IDPC Rules or the MFD Rules. Certain of these changes reflect earlier proposals included in the present Phase of the Rule Consolidation project dealing with registration categories and proficiency requirements, as detailed in the present bulletin.

As discussed in section 2.2.1 of this Bulletin, we propose to adopt the IDPC Rule approach to delegation, which permits delegation with specific prohibited exceptions itemized throughout the rules. This differs from the MFD Rule approach which prohibits delegation, unless expressly permitted.33 Regarding the delegation of supervisory tasks, both the IDPC and MFD Rules clearly state that although tasks may be delegated, responsibility for compliance remains with the delegating Supervisor.

In alignment with our proposed changes to our general delegation provision, which would allow a Dealer Member to automate tasks or activities where our rules require an individual to perform a specific function, we are proposing a new provision to ensure the Dealer Member informs the relevant Supervisor of specific tasks or activities that have been automated, ensure the Supervisor understands how the automated tasks and activities work, and ensure proper performance of the related function in compliance with CIRO requirements. (DC Rule section 3907)

IDPC Rules 3910 and 3912-3913 set out the responsibilities of the UDP, CCO and CFO, respectively. The changes proposed and discussed in the above sections do not require, at this point in time, amendments to the drafting of these Rules, which will be applied across Dealer Members.

We propose to adopt the IDPC Rule requirement to file with the CIRO any material changes made to a Dealer Member’s governance document, which sets out the organizational structure and reporting relationships of the Dealer Member.34 This provision regarding material changes to the information is currently not required under the MFD Rules but is necessary to ensure CIRO has current information, and does not represent a significant burden. (DC Rule section 3916)

We propose to adopt the IDPC Rule which requires the Dealer Member to have policies and procedures that specifically address the supervision requirements to ensure compliance with the requirements related to shared office premises, as contemplated by DC Rule sections 2216 through 2219. Mutual fund dealer compliance with these sections was proposed to be adopted for all Dealer Members in Phase 3.35 (DC Rule section 3918)

We propose to adopt the IDPC Rule provision which sets out the Dealer Members’ requirement to appoint Supervisors and alternate Supervisors as required, to supervise account opening, and activity, and establishing policies and procedures in respect of account supervision, by appointing appropriate Supervisors. Such Supervisors must have knowledge of applicable CIRO requirements, applicable laws and Dealer Member policies and procedures.

As discussed in section 2.3.3, the amended provisions reflect the proposal to replace the role of “designated Supervisor” with “Supervisor”. This provision reflects the various more general provisions in MFD Rules that require such supervision of account activities.36 Consistent with the IDPC Rules, we propose to require that all policies established or amended have supervisory approval, rather than “senior management” approval as required by the MFD Rules.37 (DC Rule section 3925)

We propose to adopt the IDPC Rule provision relating to account supervision policies and procedures. These provisions are consistent with MFDA Rule 500 – Branch Review Requirements, except for the specific requirements to:

We believe it is appropriate to apply these provisions to all Dealer Members to ensure the integrity of the markets and client records are addressed. (DC Rule section 3926)

We propose to adopt the provisions in the IDPC Rules. The detailed enumeration of specific areas to be addressed by the policies and procedures are consistent with and include most of those articulated in the MFD Rules38 . MFD Rule 200, however, includes examples of areas of concern, detailed reporting requirements, as well as thresholds for review, which we believe are more suited to be situated in guidance rather than in the DC Rule. This is consistent with the IDPC Rules approach, which contains this more specific guidance in Guidance Note 3900-20-001 Account Supervision.

We also propose to adopt the MFD Rules requirement39 that mutual fund dealers specifically designate for supervision purposes, leveraged accounts, registered accounts and accounts where the Registered Representative has full or partial control or authority over the financial affairs of the client who is a Related Person of the Registered Representative. These were areas identified as representing higher risk for mutual fund dealers, so the separate requirements for mutual fund dealers and investment dealers were retained in order to manage the regulatory risk for mutual fund dealers while not creating additional, unnecessary compliance burdens for investment dealers. (DC Rule section 3945)

We propose to adopt the provisions in the IDPC Rules, which require Dealer Members to closely supervise Registered Representatives and Investment Representatives dealing with retail clients for six months after approval, as set out in the Registered Representative / Investment Representative Monthly Supervision Report. This approach differs from the MFD Rules,40 which sets out detailed Supervisory requirements for the first and second 90-day periods comprising the six month supervision period. Consistent with our general approach to take a principles-based drafting approach to the DC Rules, we propose to provide appropriate elements of the requirements formerly contained in the MFD Rules as a suggested means to achieve compliance in accompanying guidance to the DC Rules, where appropriate. (DC Rule section 3947)

We propose to adopt a modified version of the IDPC Rule provisions relating to the supervision of specific account types that can be offered by investment dealers, namely derivatives accounts, discretionary accounts, and managed accounts. These changes are meant to clarify the current IDPC Rule drafting, and we expect that they will not impose an additional burden on investment dealers. (DC Rule sections 3960, 3961, 3970, 3971, 3972, 3973)

In this section of the Bulletin, we discuss the proposed amendments to rule requirements relating to:

that may represent a significant format or substantive change to current requirements set out in either the IDPC Rules or the MFD Rules.

The IDPC Rules pertaining to the approval process for Approved Persons and regulatory supervision of those Approved Persons set out CIRO’s authority to make certain decisions regarding the approval regime for individuals and membership of investment dealers. In particular, the authority and procedures regarding the following types of decisions are set out in IDPC Rules 9200 through 9400:

The MFD Rules and the MFD Rules of Procedure (ROP) contain similar provisions regarding Approval of Membership and Terms and Conditions on Membership.

Overview of the current regime under the IDPC Rules

Under the former IIROC Rules, the IIROC District Councils played a significant role in the decisions described above, with their exact role in that process depending on the type of decision to be made:

| IIROC Rule Section | Decision type | Application received and analyzed by | Opportunity to be heard before initial decision | Review under the IIROC Rules |

|---|---|---|---|---|

| 9204 | Individual Approval applications | IIROC District Council | IIROC District Council | IIROC Hearing Panel |

| 9205 | Dealer Membership Approval applications | IIROC District Council (recommendation) | IIROC Board | None |

| 9206 | Exemption of proficiency and continuing education applications | IIROC District Council | IIROC District Council | IIROC District Council Panel |

| 9207 | Terms and Conditions for Approved Persons, post-approval | IIROC District Council | IIROC District Council | IIROC Hearing Panel |

| 9208 | Terms and Conditions for Dealer Members’ Membership, post-approval | IIROC Staff | IIROC Senior Officer | IIROC Hearing Panel |

Following the amalgamation of CIRO’s predecessor organizations, all IIROC District Council regulatory decision-making functions were transferred to CIRO Staff. However, the decision review procedures and their distinctions were otherwise maintained:

| IDPC Rule Section | Decision type | Application received and analyzed by | Opportunity to be heard before initial decision | Review under the IDPC Rules |

|---|---|---|---|---|

| 9204 | Individual Approval applications | CIRO Staff | CIRO Senior decision officer | CIRO Hearing Panel |

| 9205 | Dealer Membership Approval applications | CIRO Staff (recommendation) | CIRO Board | None |

| 9206 | Exemption of proficiency and continuing education applications | CIRO Staff | CIRO Senior decision officer | CIRO Senior review officer |

| 9207 | Terms and Conditions for Approved Persons, post-approval | CIRO Staff | CIRO Senior decision officer | CIRO Hearing Panel |

| 9208 | Terms and Conditions for Dealer Members’ Membership, post-approval | CIRO Staff | CIRO Senior decision officer | CIRO Hearing Panel |

Per IDPC Rule section 9205, decisions regarding applications for Dealer Membership are made by the Board. Our proposal for IDPC Rule section 9205 is discussed in further detail below.

In the following sections of this Bulletin, we refer to other decisions made under sections 9204, 9206, 9207, and 9208 as “regulatory decisions”.

Streamline the decision review process for regulatory decisions

Based on the current drafting of the IDPC Rules, all regulatory decisions (meaning decisions made pursuant to IDPC Rule sections 9204, 9206, 9207 and 9208) are currently reviewed by a Hearing Panel, except IDPC Rule section 9206 decisions (regarding applications for exemption of proficiency and continuing education), which were historically heard by a District Council Panel and are currently heard by a senior review officer of CIRO.

We propose to align the decision review process for decisions made under DC Rule section 9206 with the other above-listed reviews, so that all decisions under the Proposed DC Rules sections 9204, 9206, and 9207 and 9208 will be reviewable by a Hearing Panel. This creates consistency in the decision review process and will allow applicants who have been refused a proficiency or continuing education exemption to access a Hearing Panel for review.

Furthermore, IDPC Rules 9200 through 9400 contain a multitude of definitions for similar or identical terms. These distinctions were necessary when the decision-making and review process differed depending on the type of decision made.

However, given our proposal to streamline the decision review process for Proposed DC Rules sections 9204, 9206, and 9207-9208, we propose to capture the above decisions under the definition of a ‘regulatory decision’. (DC Rule subsection 9202(1) “regulatory decision”)

The term ‘regulatory decision’ is currently a defined term used in Rule 8400, which deals with the Practices and Procedures for Hearing Panel Reviews. For clarification, we propose to expand this definition to reflect all reviews that meet this description. This achieves the primary objective of rule clarification by consistently providing a clear link in the language between Rules 9200 through 9400 and Rule 8400, which helps to convey to the reader than the decision review process is the same for these Rules.

Similarly, we propose to introduce a definition for the term ‘senior decision officer,’ which clarifies that all regulatory decisions will be made by a member of the CIRO’s Staff. (DC Rule subsection 9202(1) “Senior Decision Officer”)

Lastly, IDPC Rule section 9203 imposes certain conditions on CIRO regarding the decision review process, such as providing notice, reasons and an opportunity to be heard. Historically, this section applied to the District Council’s decisions. For this reason, IDPC Rule section 9208 contains similar conditions applied to the review processes that did not include the District Council. Given the above proposals (namely, that all regulatory decisions will follow the same decision review process), we propose to make DC Rule section 9203 applicable to all regulatory decisions.

As a result, various repetitive clauses within specific IDPC Rules (such as IDPC Rules subsections 9208(2), 9208(3)) that reference this same process will be deleted.

Clarifying changes to section titles under Proposed DC Rule 9200

To reflect the proposed changes described above, we propose to change the titles of the following sections in Rule 9200 as follows:

| Section | Current title | Proposed title |

|---|---|---|

| 9203 | Corporation Decisions | Requirements for regulatory decisions |

| 9204 | Individual approval applications | Individual approval applications |

| 9206 | Exemption applications | Exemption applications for proficiency and continuing education requirements |

| 9207 | Continued Approval | Continued individual approval |

| 9208 | Terms and conditions on membership | Terms and conditions on Dealer Members’ Membership |

Application of the regulatory decision review process to mutual fund dealers

There are no equivalent procedures for regulatory decisions set out under the MFD Rules.

We propose to apply the decision review process, including the changes describe above, to mutual fund dealers, as the same decisional powers, procedures and safeguards should apply across Dealer Members. Some of our key considerations with respect to mutual fund dealers when forming this proposal include:

Membership applications

Per CIRO General By-law No. 1 (GB1) section 3.5, when CIRO Staff receives an application for Membership, CIRO Staff must review and make a recommendation about the approval or refusal of the application to the Board. CIRO Staff is to provide a copy of its recommendation to the applicant if it proposes refusal.

GB1 section 3.5 further specifies that the Board has full discretion to decide upon an application, but must provide both CIRO Staff and the applicant with an opportunity to be heard. It also specifies that if the Board approves an application subject to terms and conditions, or refuses an application, the applicant shall be provided with the reasons of that decision.

IDPC Rule section 9205 sets out that CIRO Staff is to make a recommendation to the Board regarding a dealer’s Membership application and specifies what courses of action CIRO Staff can recommend. The list of actions CIRO Staff can recommend is inconsistent with what is set out in GB1. To reconcile this inconsistency, we recommend removing the list and referring directly to GB1. IDPC Rule section 9205 further indicates that an applicant must receive a copy of that recommendation and its reasons, and must be given opportunity to be heard by the Board prior to the Board making its decision per IDPC Rule 9400. Finally, it indicates that decisions by the Board are final under the IDPC Rules.

The MFD Rules do not contain any rules regarding the Membership application process, except for a right of review for decisions by the Board that are qualified approvals (see MFD Rules sections 8.2.1 and 8.2.2). The review of the Board’s initial decision is performed by the Board itself, or a panel/committee the Board may create, and includes an opportunity to be heard. While the MFD Rules thus include an opportunity for a mutual fund dealer to be heard by the Board, this opportunity is only available once the Board has already made its decision.

Neither of the above processes provide a fulsome nor consistent process regarding the Board’s review of a decision. As such, we propose to adopt a modified version of IDPC Rule section 9205 to simplify the Proposed DC Rule section 9205 and provide a clear link with GB1. The proposed changes to IDPC Rule section 9205 will set out the following:

The proposed changes provide an improved opportunity to be heard to applicants and a more expedient procedure, both in keeping with administrative law principles and GB1.

For these reasons, we also propose to apply this process across all Dealer Members, including mutual fund dealers. While the changes do not provide for the existing right of review that mutual fund dealers are provided under the MFD Rules (as described above, that following the Board’s decision on an application for Membership, the applicant has an opportunity to be heard by the Board), the changes instead provide applicants for Membership with an informed opportunity to be heard before the Board in all possible cases, including when the Board intends to not follow CIRO Staff’s recommendation(s). This opportunity to be heard is required before the Board renders its decision, and as such this opportunity is fairer and more reasonable to the applicant than an opportunity for the Board’s decision to be reviewed by the same Board after it has already rendered a decision on the matter.

IDPC Rule 9400 sets out the procedures for opportunities to be heard before CIRO Staff, a Senior Decision Officer, or the Board. Opportunities to be heard by a Senior Decision Officer are dealt with in Part A and opportunities to be heard by the Board are dealt with in Part B of IDPC Rule 9400.

There is no equivalent procedure set out in the MFD Rules, other than the MFD ROP regarding the right of an opportunity to be heard by the Board in case of a review of a Board decision, which we have described above.

Clarifying changes

To reflect the changes proposed in the previous sections of this Bulletin, we propose the following clarifications to the language set out in IDPC Rule 9400:

Application to mutual fund dealers

Given the primary objective of rule harmonization, and given the rationale set out in this Bulletin under section 2.3 (wherein we propose that the Approved Person regime in the IDPC Rules should generally be extended to mutual fund dealers, albeit with some qualifications), we propose to extend the regulatory decisions and review regime that support the Approved Person and Membership processes to be applicable across all Dealer Members, including mutual fund dealers.

As the Rule Consolidation Project is being pursued in five phases, and the combined impact of the project can only be assessed once development of all five phases has been completed, it would be misleading for us to assess the impact of each phase in isolation from the other phases or to make an assessment of the combined impact of the five project phases until all phases have been developed.

To provide you with some impact information in the interim, we will identify the impacts specific to each project phase as each project phase is published for public comment. We will provide an overall Rule Consolidation Project impact assessment once all 5 phases have been developed.

We have assessed the impact of the material changes being introduced as part of the Phase 4 Proposed DC Rules as having an overall positive impact on investors; net-neutral impact for CIRO; mostly neutral with some positive impacts for investment dealers, and; net-positive impacts for mutual fund dealers. In general, the impact of Phase 4 on mutual fund dealers is to provide them with more flexibility in how they conduct their business. To address uncertainty members may have when moving from prescriptive Rules to principles-based Rules, CIRO will continue to provide guidance. The guidance will contain more detailed suggestions for members to achieve compliance. The benefits of the new flexibility afforded to mutual fund dealers may be somewhat offset by certain more stringent documentation and record keeping requirements, which would likely be new to only the smaller mutual fund dealers, and additional regulatory requirements with respect to the Approved Person categories and corresponding proficiencies. Ultimately, we concluded the negative impacts in the impact analysis are outweighed by the overall positive impacts.

A complete impact analysis of the Phase 4 Proposed DC Rules is attached as Appendix 4.

We have identified no regional impacts associated with the Phase 4 Proposed DC Rules.

We did not consider any alternatives to rule consolidation, such as maintaining separate rules for investment dealers and mutual fund dealers as, based on the feedback provided in response to CSA Position Paper 25-404, New Self Regulatory Organization Framework, we determined that there is general cross-stakeholder support for rule consolidation.

While comment is requested on all aspects of the Phase 4 Proposed DC Rules, comment is also specifically requested on the following questions:

| Question #1 - Definition and application of “investment product” |

Will the revised definition, and application of the term “investment product” provide additional clarity to the scope of Dealer Member obligations to clients? What additional investment products should we consider obtaining Board approval to include in this definition? Are there different products that should be added for different regulatory purposes? |

| Question #2 - Applying CFO requirements to mutual fund dealers |

We recognize that requiring mutual fund dealers to appoint a CFO may be a significant material change to the governance and resourcing requirements of many such dealers. We are seeking feedback on several points regarding this proposal:

|

| Question #3 – Proficiency requirements and the Approved Person regime for UDP of mutual fund dealers |

To avoid an overly burdensome approval process, we proposed that mutual fund dealer sponsored individuals that are registered in the appropriate registration category under securities legislation should be automatically approved as an Approved Person under the DC Rules. However, an important distinction exists between the CCO and Dealing Representative categories, which rely on a review process by relevant securities regulatory authorities and minimum proficiency requirements to obtain registration, versus the UDP, which is also reviewed but not required to meet minimum proficiency requirements.

|

| Question #4 – Implementation for existing (unregistered) Approved Persons of Mutual Fund Dealer Members |

With respect to the categories of Approved Persons of mutual fund dealers that are not subject to a registration requirement under securities legislation, we have generally proposed these Approved Persons conform to CIRO’s Approved Person regime and corresponding proficiency requirements. Our view is that these roles have significant oversight responsibilities that justify this potential additional regulatory burden on mutual fund dealers. However, the same rationale may not apply for Directors. We expect that directors of mutual fund dealers who were not previously subject to proficiency requirements may not be ‘actively engaged’ in the activities of the business of the mutual fund dealer and do not play an operational, oversight nor managerial role in the dealer’s business. Under the current proposals in Phase 4, these mutual fund dealer Directors would be subject to a CIRO approval process and net-new proficiency requirements. To what extent would it be appropriate to grandfather the existing Directors of mutual fund dealers into the Approved Person regime? Please advise if there are significant concerns regarding this approach, particularly regarding the lack of minimum proficiency requirements of existing mutual fund dealer Directors and whether this could undermine investor confidence in mutual fund dealer as compared to investment dealers. |