Alert:

Finance and Investing Guide for Canada’s Service Members, Veterans, and their Families

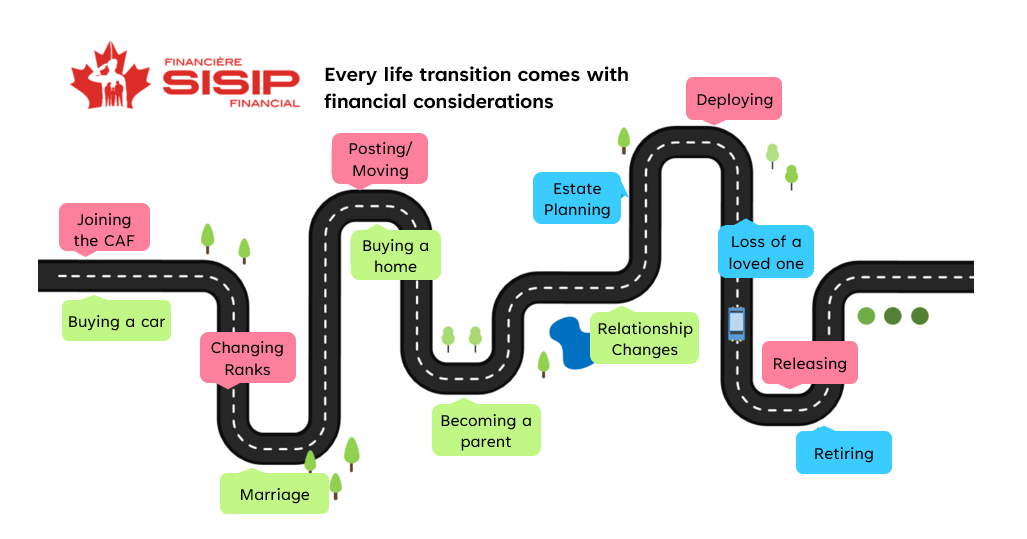

Canadian Armed Forces (CAF) members and their families face unique circumstances which can affect their personal finances. This guide aims to provide a general approach to managing finances, with key considerations and resources specific to your situation.

Common Sources of Financial Stressors

Canadian families and their finances are commonly affected by:

- changes to income and/or employment;

- unexpected expenses;

- physical and/or psychological disabilities;

- addictive behaviors (alcohol, cannabis, gambling);

- rising living costs, and;

- major life events (e.g., marriage, divorce, birth of children, illness, etc.).

Additional Considerations for Service Members

You may face additional financial stressors as a result of high risk employment and uncertainty around relocation and deployment. Frequent relocations and deployments also affect spousal employment opportunities and advancement. Fortunately, there are many resources designed specifically to help you and your family stay ahead of and overcome these challenges.

Where to Begin

For all Canadians, reviewing your financial situation thoroughly is a great starting point to get ahead of the stressors listed above. This guide includes a printable checklist to track your progress as you navigate each step at a time:

1. Create a budget

- Identify your debts and focus on prioritizing paying down the highest interest rate bearing loans or debt, such as credit cards and payday loans.

- Choose your short-term and long-term financial goals and learn about investing basics to put your plan into action.

- Short-term goals might include buying a new car or planning a vacation while longer-term goals could include covering your child’s education costs or having a larger retirement nest egg.

Get started today with:

Important: be sure to update your budget, emergency fund and investment strategy as your life changes based on any of the above considerations or contact your trusted SISIP Financial (SISIP) advisor for assistance.

2. Have a Backup Plan

- Have an emergency fund to cover unexpected expenses and build financial resilience when facing last minute relocation, injury or disability, home and car repairs, spousal unemployment, and more.

- The Financial Consumer Agency of Canada suggests saving the equivalent of 3 to 6 months of your regular expenses, although it very much depends on your circumstances.

- Draft a will, a power of attorney, designate account beneficiaries, and appoint a Trusted Contact Person to fulfil your wishes and protect your family in the worst case scenario.

Additional resources

The Support our Troops Fund provides a series of financial support programs for CAF members and their families. These programs include emergency financial assistance, special needs grants, support for the ill and injured, education assistance, the National Summer Camps Program, and community development grants.

Applications for emergency financial assistance for veterans and their families are submitted and processed through Veterans Affairs Canada and/or the Legion. Learn more about the Veterans Emergency Fund, including whether you qualify for support, how to apply and FAQ’s.

To learn more about these programs and how to apply, please visit Support our Troops or contact your local SISIP financial counsellor who will support you in completing your applications.

3. Plan for an Eventual Return to Civilian Life

- Veteran Affairs Canada (VAC) provides a first step in helping you transition to civilian life, along with tailored support to members and Veterans who experience a service related illness or injury.

- The Legion’s Command Service Officer can also provide assistance with accessing VAC programs and benefits, such as injuries/illnesses related to service.

- As a veteran, you can look forward to receiving a lifetime pension through the Canadian Armed Forces Pension Plan.

- Understand your pension and sources of income by creating an illustrative plan for your future.

Consider meeting with a registered financial advisor or your trusted SISIP financial advisor to discuss whether your pension and savings will provide you with the retirement lifestyle you want and expect. Your SISIP Financial advisor will help you to map out your future with a detailed financial projection.

4. Be Aware of Investment Fraud

It is hard to believe fraudsters would target CAF members or veterans but it does happen and shows the lengths bad actors will go when seeking to profit.

How you could be targeted:

- Encouraged to invest your pension in a ‘once in a lifetime’ opportunity;

- As a member of a respected and trusted group, you could be exploited by a fellow CAF member (or pretend member) with a “once in a lifetime” opportunity or “guaranteed return” etc., and;

- You could be pressured into an investment opportunity to “benefit” your family (by exploiting the fear of being harmed in the line of duty).

How you can protect yourself:

- Always be suspicious when contacted about an investment opportunity;

- Check that the person and/or company you're investing with is registered, and;

- Avoid committing to an investment opportunity in the moment by taking time to consider your options. Perform your own research before making any decisions.

How we can help:

For more information on how to avoid fraud, how to report suspected fraud, how to file a complaint against an investment advisor, and more, please visit CIRO’s resources on avoiding fraud.

Resources

Financial programs and services for all CAF members (former and current)

Financial programs and services specific to veterans

Financial assistance

To file a complaint or seek recourse

Retirement supports

Investing basics

Avoiding investment fraud