Alert:

Youth Guide to Finance and Investing

Hey there, future investor! As a national regulator, it's our mission to make sure financial markets are fair and transparent for everyone, including you. We know finance can seem complicated and intimidating and we’re here to help get you started on your journey.

In this guide, we demystify the world of investing and show you how taking control of your personal finances can be quite simple. Your future self will thank you.

A Youthful Profile

Every stage of life comes with its own unique circumstances, which affects your personal finances. What makes young Canadians a unique group?

- Young Canadians do not earn high salaries on average. (The median income for Canadians aged 15 to 29 was $25,000 in 20211 ).

- Through friends, music, school, and social media there’s often an intense pressure to ‘fit in’ with the latest (and most expensive) brand names.

- Student loans, car payments, record high rents….who said growing up was cheap?.

- A lack of experience with investing, budgeting, and other topics of personal finance.

So you’re saying young Canadians like me often don’t have much money or assets and carry high levels of debt? Why would fraudsters target me?

Scammers tailor their methods to their audience and can use your ‘Youthful Profile’ against you. Scammers will exploit your lack of financial experience by pretending to be an experienced investment advisor, use complex language to confuse you, and/or pressure you into exploitative opportunities. The classic ‘get rich quick’ scheme for example is easily tailored to the young and inexperienced, particularly through social media where anything can be faked.

Check out our complete catalogue of anti-fraud resources to keep yourself safe.

Let's get started on your financial journey!

1. Borrowing Money

Student loans, a line of credit, car payments, cell phone bills and credit cards are only a few common debts young Canadians carry. Payments are typically made monthly with a portion going to the principal (the amount you borrowed) and some to interest (the cost to borrow).

1.1 Not All Debts Cost the Same

The cost of debt (a.k.a. the interest rate) varies from who, where, and how you borrow. For example, student loans from the government typically cost much less than credit cards. You should always be aware of and understand the interest rate on a loan before you sign on the dotted line. Even a small amount of interest can be very expensive on a large loan.

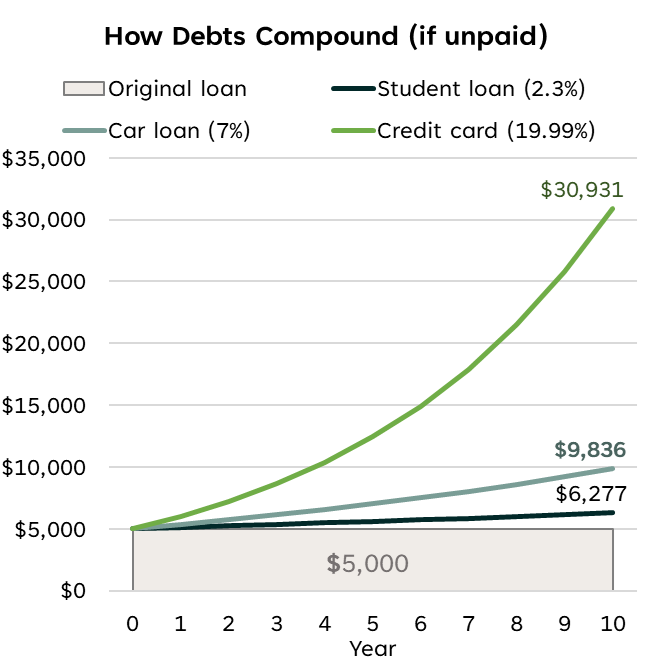

1.2 The Interesting Effect of Compounding

Compounding simply means continuous growth. Imagine you grew 10% taller everyday. Today you would have grown by more than yesterday, and tomorrow you will grow by more than you did today. This effect can apply to your debts if you miss payments.

The graph shows how quickly debt can spiral out of control if you miss payments. After 10 years, a $5,000 loan would cost:

- over $6,000 as a student loan (2.3% annual interest);

- nearly $10,000 as a car loan (7% annual interest);

- over $30,000 as a credit card loan (19.99% annual interest).

1.3 Know the Benefits of Borrowing (Responsibly)

While our compounding example above is shocking, debt is a necessary feature of many successful financial plans. Why?

- Able to do more. Paying for post-secondary education, financing a car, buying a home and starting a business would not be possible for many Canadians without borrowing money.

- Building a credit history

Why does it matter?

Everyone has a credit score which tells the world how reliable you are when it comes to paying back a loan on time and in full. A high score makes it easier to borrow more and for cheaper.

When will my credit score matter?

Cell phone plans, home utilities, credit cards, and internet all provide something upfront you promise to pay for later (e.g., your current cell phone bill reflects your texting and data usage from last month).

- Even employers can access your credit score!

How do I get a good credit score?

Step 1 is getting credit. Consider a no annual fee credit card or cell phone plan in your name (make sure it’s one you can afford).

Step 2 is pay off your bills each month, on time and in full! Making the ‘minimum’ payment or skipping a bill altogether means you will start owing interest while also lowering your credit score.

How do I check my credit score?

There are two main credit bureaus in Canada which can provide you with your credit score:

- Equifax and TransUnion

For more information on your credit report and score basics check out the Government of Canada's resources.

Takeaways

- Borrowing money doesn’t have to be bad or scary if done responsibly.

- Consider building your credit with a no annual fee credit card (only using it to buy the essentials) and pay all bills on time and in full.

- Prioritize paying down debts with the highest interest rate first.

2. Planning a Budget

Social science tells us we’re “present bias” – we tend to care more about the here and now than the future2 . Ever gone for one scoop of ice cream and finished the whole tub? Ever spend half of your paycheck on shoes instead of next months rent? Yeah, us too! Luckily, budgeting can help reign in our self-control while still allowing room for spending on fun things.

2.1 How it Works

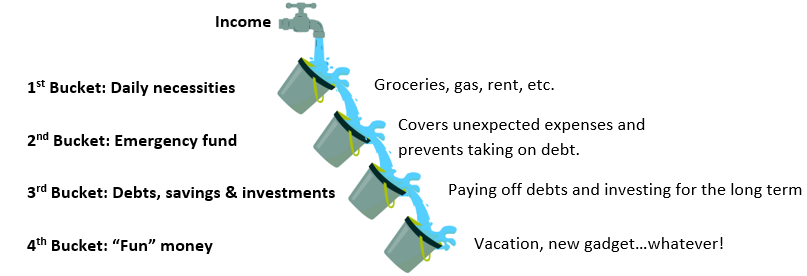

The ‘bucket’ or ‘waterfall’ technique is a simple way to think about prioritizing expenses in your life. You begin by filling your first bucket, and only once it’s full can you move onto your next bucket, and so on down the line. Your waterfall of cash keeps the most important buckets full while leaving room for a reward at the end.

2.2 Daily Necessities

Ask yourself, is it a want or a need?

If it’s something you need, you’ll want to make sure it’s covered here. Rent, gas for the car, groceries, all things we need in order to get by.

2.3 Emergency Fund

Ask yourself, how much cash could I have ready today if I really needed it?

According to a 2022 StatsCan survey, 26% of Canadians said they could not afford a sudden $500 expense3 . That’s roughly 10 million Canadians! The Financial Consumer Agency of Canada suggests saving the equivalent of 3 to 6 months of your regular expenses, although it very much depends on your circumstances.

Although it may be tough to have a sizable emergency fund set aside, any amount can help keep you out of debt and avoid desperation when faced with a large and unexpected expense.

2.4 Debts, Savings and Investments

Ask yourself, how can I start making progress toward my financial goals?

Your daily expenses are covered. You have rainy day fun money just in case. Now you can start thinking about paying down debts or saving and investing for your long term goals such as buying a home or retirement. We have resources to help you consider whether to pay down debt or invest to get started.

2.5 “Fun money”

Give yourself a pat on the back for making it this far. This is where wants can come before needs – but only if your other buckets are still overflowing!

Takeaways

- Budgeting is all about prioritizing your expenses.

- Determine your buckets and keep them overflowing.

- Needs > wants…until you reach your “fun” bucket!

3. Investing

Saving is the act of storing cash; for example in a bank account. Your savings may not earn significant amounts of interest but you can access your money freely at any time.

Investing offers a way to potentially grow your money in a different way from savings. When you invest, you use your money to buy assets that you hope will grow and/or create income. You can buy stocks, bonds, mutual funds, among many other options. Investments can gain in value, lose value or stay the same depending on what you invest in and for how long.

3.1 Why Consider Investing?

Whether your goals include a vacation, new car, first home, retirement, or anything in between, investing responsibly can get you there much faster than by savings alone. Investing is a way for anyone, of any background or income, to build wealth over time. You might be surprised at just how easy it can be.

Tip #1

Find a $20 bill in your jacket pocket? Invest it! Set up regular contributions to your investment account and watch how quickly your nest egg can grow over the years.

We’ve prepared 5 Key principles of Investing for you to consider before starting your journey.

Can you afford to invest?

If you’re finding it difficult to afford the necessities (rent, groceries, etc.) investing may not be something to consider right now.

Are you willing to diversify?

By investing in multiple different assets, industries or regions, you can reduce your overall amount of risk taking.

Invest for the long-term

Long-term investors (think decades) generally experience better returns as asset values typically increase over time.

Understand risk vs. return

High risk can mean high reward – or, big losses. Curious about how risky of an investor you are? Check out our Investor Questionnaire.

Understand your investments

Consider the 3 W’s: WHERE is your money invested? WHO is handling your investment, and WHAT are you invested in?

If you don’t understand how your investment grows, what the costs are, or the risks, you should consider something less complicated.

3.2 How to Start Investing

There are two ways to get started, either on your own or with the help of an investment advisor. Each has its own pros and cons, to name a few:

On Your Own

Pros

- Freedom to customize

- Encourages your learning

- Often lower fees/costs

Cons

- No experienced 2nd opinion

- Requires researching options

With the Help of an Advisor

Pros

- Experience

- Strategy is updated for you

- Advice beyond investing

Cons

- Associated fees/costs

- Possible limitations on investment options

Resources

Regardless of how you start, only invest with a person or firm who is registered. We have many more resources to help you understand investing basics and know your rights as an investor.

Tip #2

If you’re overwhelmed or confused it might be worth making an appointment to speak with an advisor. You shouldn’t be charged for their services until you invest and you can always ask for a second opinion.

3.3 How to Invest Safely

The only reason someone would approach you with an investment opportunity is because they stand to benefit. It could be fraud or an honest opportunity, but if they approach you, they have something to gain. If someone had a hot stock tip or found a way to make consistently high returns do you think they would share their strategy out of kindness? Of course not!

Technologies also make it too easy for fraudsters to operate anonymously from anywhere. As a regulator, we would love to be able to stamp out investment fraud altogether. The difficulty is in predicting fraud and we typically cannot intervene until it is too late.

Easy as 1-2-3: Here are the basic ways to protect yourself:

- Keep your online activities secure.

- Stay skeptical and learn how to spot the red flags of fraud.

- When you do invest, confirm the person or firm you’re working with is registered with CIRO.

3.4 If You Suspect Fraud

If you suspect fraud or believe you may be a victim of a scam:

- Stop sending money;

- Collect your thoughts and document your experience;

- Report the fraud, and;

- Secure your information and accounts.

Find out what to Do If You’re a Victim of Fraud.

One of the biggest crypto-related complaints CIRO receives from Canadian investors is around fraud and unregistered platforms/exchanges. Crypto exchanges can be run by anyone and from anywhere in the world. Without oversight, these platforms can lock you out, restrict trading, or disappear with your investment. There’s very little regulators or police can do to return your stolen funds.

- If you want to trade crypto, check this list to see if the platform is registered.

Takeaways

- Make sure you understand the 5 Key Principles of Investing.

- Only invest with a person or firm who is registered.

- Stay skeptical. Stay safe.

4. Renting vs. Buying a Home

Knowing whether renting or buying is the best option for you over a lifetime is impossible to say.

4.1 Financial Considerations

If you want to evaluate each option from a financial perspective, you will need to consider, among other data points:

- home prices in your area;

- current mortgage rates;

- how much of a down payment you can afford;

- how much of a mortgage you could qualify for, and;

- rent prices in your area;

Although you should consider all of these variables to make an informed decision, it might be worth starting simple.

4.2 Starting Simple

You (and your partner) could start by asking:

- Where do I (we) want to live?

- Do I (we) have steady income?

- Do I (we) have or want a family?

- Do I (we) want to live in a city centre, suburb or small town?

- Would buying a home in the suburbs or rural community require one or more vehicles to get around?

4.3 Pro's and Con's of either Option

| Renting | Buying | |

|---|---|---|

| Pro |

|

|

| Con |

|

|

Takeaways

- Deciding whether to rent or buy depends on many factors and your unique situation.

- Despite social pressures, there’s nothing wrong with renting throughout your life if it suits your lifestyle and finances. Start simple before getting too far into the financials.

5. Retirement 101

It may sound strange to think about retirement now. However, the day will come when you no longer want to work or are physically unable. Maximizing the likelihood you can retire in comfort (or at all) is a lifelong journey. The Office of the Investor’s 2024 Investor Survey revealed retirement as the most cited investment goal.

5.1 How to Make Money When You Are No Longer Working

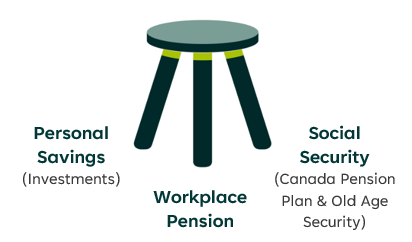

Retirement income can be thought of as a stool. Many Canadians depend on all three legs to achieve stability:

- Personal savings from investments;

- Workplace pension plans; and

- Social security plans.

5.1.1 Personal savings from investments

The younger you are, the more time you’ll have to invest and reinvest your returns while benefitting from compounding growth. RRSP’s are a great option to segment investments specifically for retirement and Section 3 can help you get started on your investing journey.

5.1.2 Workplace pension plans

Some Canadian employers offer a pension plan as part of their employee benefits. The two main types are defined benefit and defined contribution.

| Defined Benefit (DB) Pension Plan | You and your employer both contribute into a fund which is managed by an investment firm. After a set number of years working, you can count on a guaranteed amount each month as long as you live.

|

|---|---|

| Defined Contribution (DC) Pension Plan | You and your employer both contribute into an account which you must manage yourself, or select an investment firm to manage for you. It will then be up to you to draw down your account throughout retirement.

|

In either plan, your employer will often match your contributions up to a certain amount. That means free money! You should always include pension and retirement planning as part of your compensation discussions with employers.

5.1.3 Social Security

If you work in Canada you are required to pay into social security programs which are automatically deducted from your pay. Once you retire, you will then get money back from the government through the Canada Pension Plan (CPP) and Old Age Security (OAS).

You can receive payments from the CPP as early as age 60 and OAS as early as age 65. How much you received depends on how long you have lived and worked in Canada. Income from these programs alone are not meant to support a successful retirement.

Takeaways

- Many Canadians will rely on income from 3 sources to be comfortable in retirement:

- Workplace pension;

- Private savings, and;

- Social security.

- The Office of the Investor’s 2024 Investor Survey revealed retirement as the most cited investment goal.

- Find out if your workplace offers a pension plan and, if so, contribute.

- Save early, save often.