Alert:

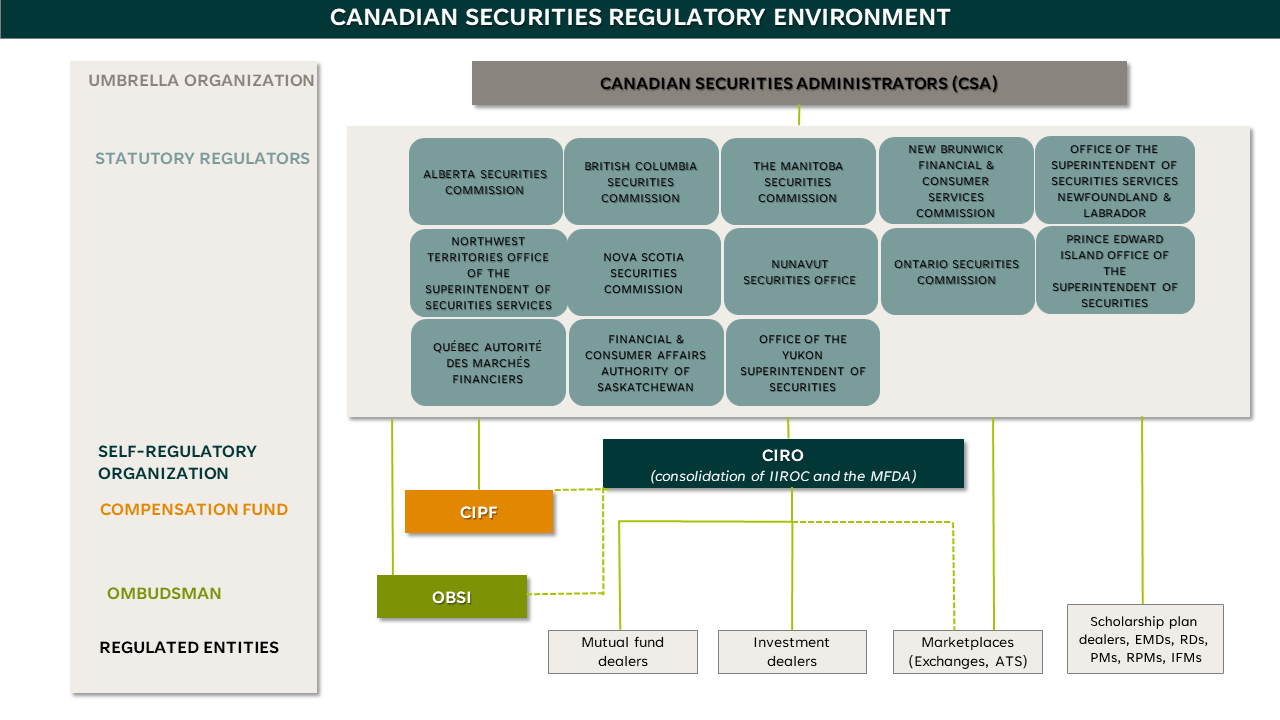

Where We Fit in the Canadian Securities Regulatory Framework

Our Partners in the Regulatory Framework

CIRO works within the Canadian regulatory framework to help contribute to investor confidence and security. In collaboration with these other organizations, CIRO is committed to the protection of investors and maintaining the integrity of the Canadian capital markets. We want to build Canadians’ trust in financial regulation and the people managing their investments. Here are some of our partners in the Canadian regulatory system:

Canadian Securities Administrators (CSA)

The 10 provinces and 3 territories in Canada are responsible for securities regulations. Securities regulators from each province and territory together form the Canadian Securities Administrators, or CSA for short. The CSA is the umbrella organization of Canada’s provincial and territorial securities regulators whose objective is to improve, coordinate and harmonize regulation of the Canadian capital markets. CIRO carries out its regulatory responsibilities under “Recognition Orders” from each of the provincial and territorial securities regulators that make up the CSA. The CSA relies on CIRO to oversee investment dealers and mutual fund dealers in Canada. The CSA jurisdictions directly oversee other securities registrants including Exempt Market Dealers (EMDs), Scholarship Plan Dealers (SPDs), Restricted Dealers (RDs), Portfolio Managers (PMs), Restricted Portfolio Managers (RPMs) and Investment Fund Managers (IFMs). Learn more about registration categories. Understanding registration categories is important as it affects what products and services your firm and advisor can offer to you.

Canadian Investor Protection Fund (CIPF)

The Canadian Investor Protection Fund (CIPF) is the organization that manages the industry compensation fund for CIRO Members. CIPF's mission is to contribute to the security and confidence of customers of CIRO Members by maintaining adequate sources of funds to return assets to eligible customers in cases where a member firm becomes insolvent. All CIRO Dealer Members are members of CIPF. Find out more about what CIPF does and does not cover.

Ombudsman for Banking Services and Investments (OBSI)

All CIRO Dealer Members must be Members of The Ombudsman for Banking Services and Investments (OBSI). OBSI resolves disputes between CIRO Members and their customers. OBSI is independent and impartial, and their services are free to customers of CIRO Member firms. As an alternative to the legal system, they work informally and confidentially to find a fair outcome. While customers must first complain to the firm involved, if they remain unsatisfied they have a right to bring their complaint to OBSI. Learn more about OBSI and their complaints process.

It is important to note that customers can also complain directly to CIRO at any time regarding CIRO-regulated investment dealers or mutual fund dealers.