Alert:

Understanding Risk

Let’s talk about risk

Risk is an important factor to consider when investing and planning for your future. We all work hard for our money, so it makes sense that we would want the highest possible returns from our investments. But when thinking of investing and possible returns, it is important to understand risk. In particular, understanding the relationship between (1) risk and return, (2) one’s own risk profile and (3) the risk of the investment products or overall portfolio one is considering. The information below will provide you with some basic information on risk that you can consider when working with your advisor.

Risk and Return

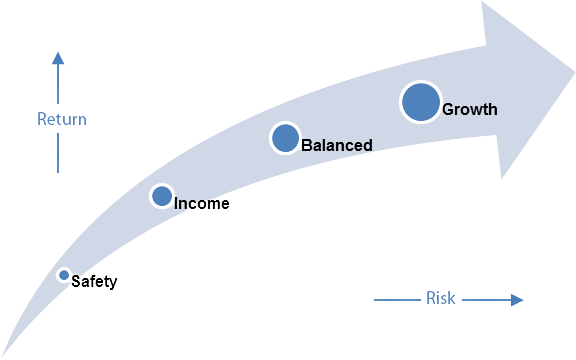

Risk and return are directly related. With higher risk comes a higher possible return, but also a higher possible loss. If one invests in lower risk products, there is a decreased chance of suffering a loss but investment returns will be lower. Consider the relationship between risk and return to be like a rule that cannot be broken, which is why you should be careful about any security that claims to be a low risk and high return investment. Whenever you hear from a friend, family member or through the news that a certain investment has significantly increased in value, you can assume that there is some risk in owning that investment. It is in no way certain that the value of the investment will continue to increase. In fact, the investment could suffer a major loss in the future. This can be contrasted with “safe” investments such as money market mutual funds or GICs where there is a very low risk that you will lose your initial investment but where your rates of return will generally be lower. This applies to the construction of an investment portfolio as well. A portfolio constructed for safety may have a lower rate of return while a growth portfolio may have the potential for a higher rate of return but also a higher risk for financial loss. The investment objective of the portfolio that is suitable for you will depend on the balance between the return you are looking for and your risk profile.

Your Individual Risk Profile

Now that we understand the risk-return relationship, we should consider our own individual risk profile. Having a sense of your own individual risk profile can be helpful for your advisor, who can create an investment portfolio that takes into account your investment needs and the amount of risk you can take. Your individual risk profile is specific to you. A risk profile has two separate parts to it:

Risk tolerance: Risk tolerance captures your willingness to take on risk and to deal with uncertainty. A good way to think about risk attitude is the “sleep at night test”, meaning how much investment risk or uncertainty are you willing to take before it would become uncomfortable and interfere with a good night’s sleep? Risk tolerance is a subjective meaning that is very specific to you, your preferences and comfort level.

Risk capacity: Risk capacity is your objective ability to take on financial risk. By this, we mean how much of your investments can you lose without negatively affecting you and your life. Your risk capacity depends on factors specific to you and your family such as your income, savings, employment status, age, debt levels, health status, etc.

Between your risk tolerance and your risk capacity, your overall risk profile should reflect the lower of the two. For example, an investor who is comfortable taking on high levels of risk (risk tolerance) but who has a low income relative to their expenses, limited savings or unstable employment may not have enough financial resources to withstand a significant financial loss. This investor’s risk capacity may therefore be lower than their risk tolerance, which will reflect their overall risk profile.

Assessing Your Risk Profile

Your advisor should ask you several questions to understand both your risk tolerance and risk capacity. For example, your advisor may provide you with various investment scenarios with different potentials for gains and losses and ask you to report your comfort level with each scenario. Some advisors may use investor questionnaires that pose several questions to assist you and your advisor in assessing both your risk tolerance and risk capacity. The more prepared you are to discuss your investment needs, goals financial situation and feelings regarding investing with your advisor, the more they will be able to guide you in specifying your risk profile and constructing an investment portfolio for you. In preparing to discuss risk with your advisor, you can review and think about the questions in the Investor Questionnaire.

Always Reassess Your Risk Profile

Finally, your risk profile can change over time as your attitudes towards risk or financial circumstances affecting risk capacity can change. Work with your advisor to re-assess your profile if there has been a change in your financial status or in your life circumstances such as birth of a child, change in marital status, retirement or changes to your health or employment.